An Opportunity to Get In On the Ground Floor

An Opportunity to Get In On the Ground Floor

5 Surprising reasons this company’s new technology could disrupt the soon-to-be $59 billion online fitness market.

Watch this brief video below for the full story now — or read on to discover the 4 surprising reasons why the GRIT EPIQ could provide early investors an opportunity to get in on the ground floor of what could be the next hot thing in the connected fitness industry.

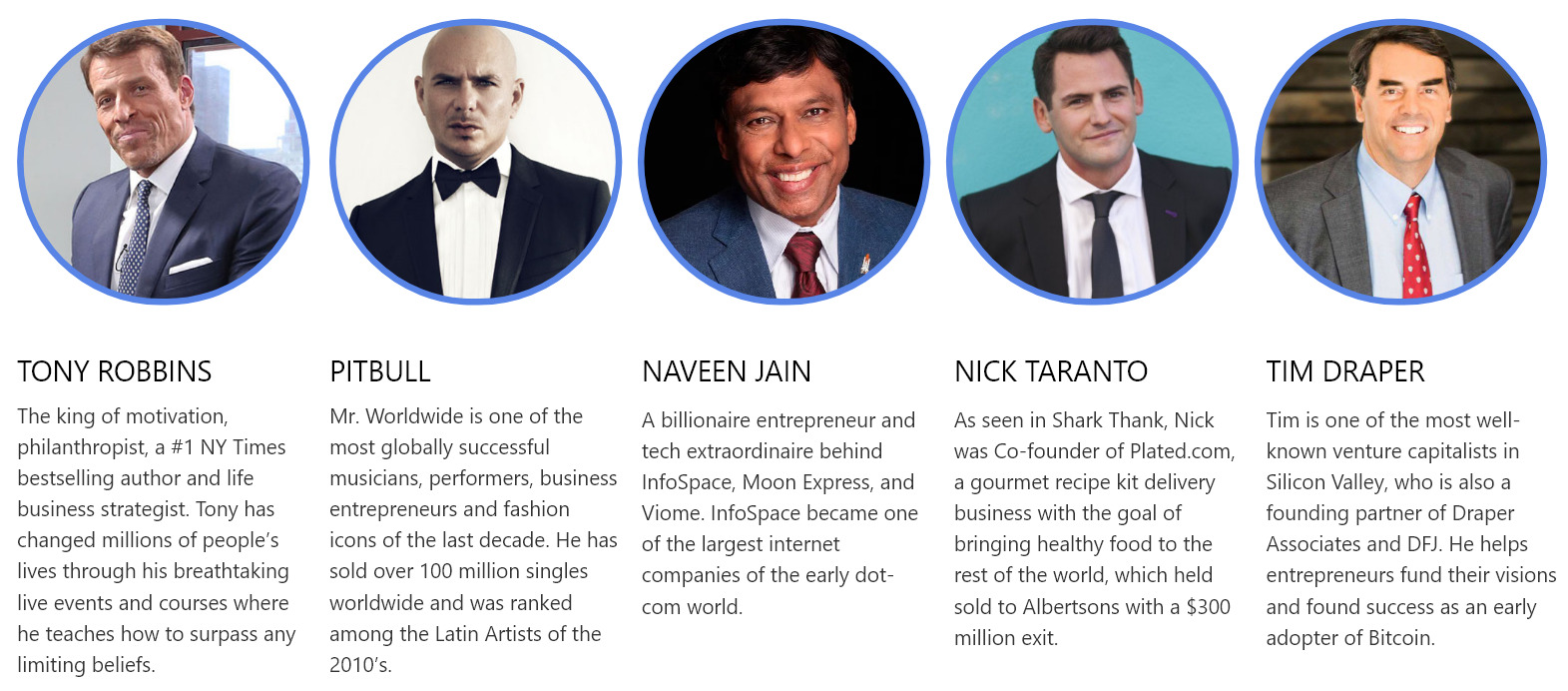

Discover why smart, influential business people like Tony Robbins, Pitbull, Tim Draper, Nick Taranto, Lucy Guo, and Naveen Jain are all equity holders in this game-changing fitness company and how you can join them!

The Almost $60 Billion fitness industry

has quickly shifted into a virtual world…

Now the spotlight has come down to at-home equipment, streaming services and virtual trainers.

![]()

Discover why smart, influential business people like Tony Robbins, Pitbull, Tim Draper, Nick Taranto, Lucy Guo, and Naveen Jain are all equity holders in this game-changing fitness company and how you can join them!

The Almost $60 Billion fitness industry

has quickly shifted into a virtual world…

Now the spotlight has come down to at-home equipment, streaming services and virtual trainers.

![]()

AN EXCITING GROWTH

OPPORTUNITY HAS NOW EMERGED.

AN EXCITING GROWTH

OPPORTUNITY HAS NOW EMERGED.

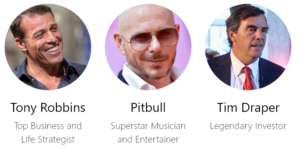

An A-List team of business people have gotten behind this company, including:

Tony Robbins

Top Business and Life Strategist

Pitbull

Superstar Musician and Entertainer

Tim Draper

Legendary Investor

Nick Taranto

Shark Tank Entrepreneur

Naveen Jain

Billionaire Entrepreneur

Lucy Guo

Silicon Valley Unicorn & Investor

Thanks to a recent change in regulations, you now have the ability to join this high-profile group and stake your claim in the start up phase of this exciting company. This scenario is unfolding now with

GRIT – an up-and-coming fitness company looking to become the next big connected fitness success.

HERE’S HOW:

Institutional investors often have an early opportunity to purchase as many shares as they could in exciting new startup companies, while individual investors were left out in the cold. Thanks to the JOBS Act, everyday, individual investors can now invest early in startups, and potentially reap the rewards that were usually exclusive to large, institutional investors.

Right now, you have access to the type of opportunity previously available mostly to the largest and most well-connected investors. As a matter of fact, you now have a surprising opportunity to get in on the ground floor of what could be the next breakout star of the soon-to-be-$59 billion online fitness market.

This is a company following a path others have forged in the industry — with an aim to learn from these predecessors — while carving out an opportunity for individual investors to stake their claim at this early stage. This opportunity is with GRIT – a company with proven experience in the fitness industry and an all-star management and equity holder team, providing a digital at home fitness experience product designed by the mastermind designer behind the Peloton bike.

Thanks to a recent change in regulations, you now have the ability to join this high-profile group and stake your claim in the start up phase of this exciting company. This scenario is unfolding now with

GRIT – an up-and-coming fitness company looking to become the next big connected fitness success.

HERE’S HOW:

Institutional investors often have an early opportunity to purchase as many shares as they could in exciting new startup companies, while individual investors were left out in the cold. Thanks to the JOBS Act, everyday, individual investors can now invest early in startups, and potentially reap the rewards that were usually exclusive to large, institutional investors.

Right now, you have access to the type of opportunity previously available mostly to the largest and most well-connected investors. As a matter of fact, you now have a surprising opportunity to get in on the ground floor of what could be the next breakout star of the soon-to-be-$59 billion online fitness market.

This is a company following a path others have forged in the industry — with an aim to learn from these predecessors — while carving out an opportunity for individual investors to stake their claim at this early stage. This opportunity is with GRIT – a company with proven experience in the fitness industry and an all-star management and equity holder team, providing a digital at home fitness experience product designed by the mastermind designer behind the Peloton bike.

HERE ARE

5 REASONS

5 REASONS

WHY YOU SHOULD JOIN IN ON THIS OPPORTUNITY NOW

WHY YOU SHOULD JOIN IN ON THIS OPPORTUNITY NOW

REASON #1:

REASON #1:

ONLINE FITNESS IS THE

#1 FITNESS TREND FOR 2021 AND PRESENTS A

$59 BILLION OPPORTUNITY

The online fitness market is in the early stages of a massive growth phase. What was a $6.04 billion market as recently as 2019 is projected to grow at a staggering pace over the next six years. Experts at Allied Market Research are forecasting a compound annual growth rate (CAGR) of 33.1% for the online fitness industry between now and 2027 with the market reaching $59.23 billion by 2027. That type of rapid growth represents tremendous opportunity for companies that

establish a truly dominant position in the market.

And GRIT is developing the GRIT EPIQ and believes it will be well positioned to do just that – offering investors an opportunity to invest in a company combining technological innovation with explosive market growth potential.

This rapid market growth, of course, is a direct result of a seismic shift in consumer behavior that has made online fitness more popular than ever. According to the American College of Sports Medicine (ACSM), online training is the #1 top fitness trend for 2021.

Investors looking to take advantage of this dramatic – and very likely permanent – change in consumer behavior could be investing in the early stages of the rapidly-growing online fitness market.

GRIT EPIQ offers investors a chance to not only get in at an early stage of this red-hot market, but also offers an opportunity that has traditionally been reserved for institutional investors and Venture Capitalists.

Reason #2

COMBINING THE FOUNDERS’ PROVEN TRACK RECORD

WITH THE EXPERIENCE OF

THE MAN WHO DESIGNED

THE PELOTON BIKE

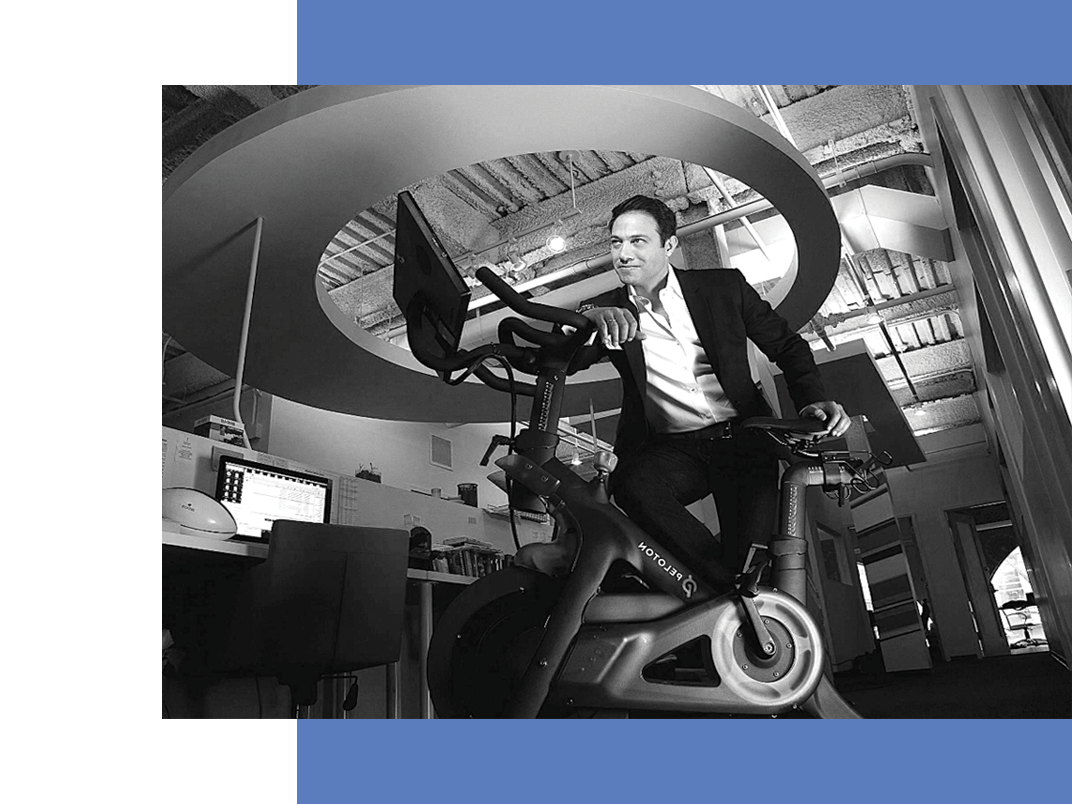

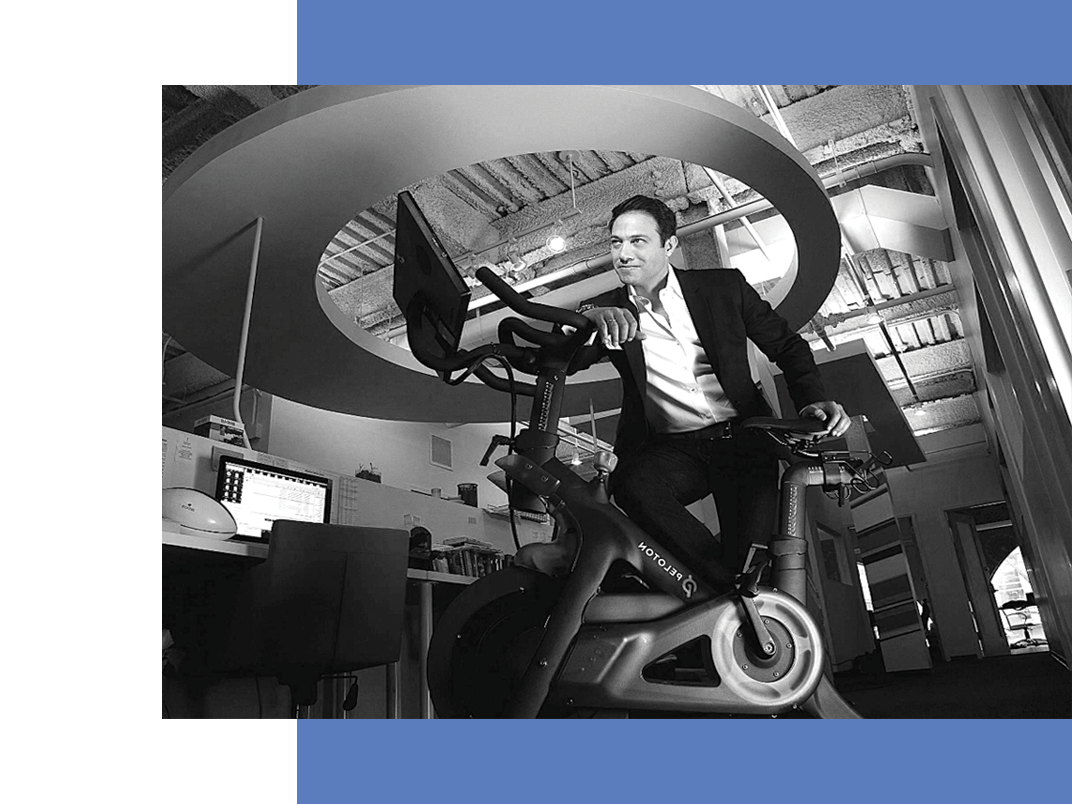

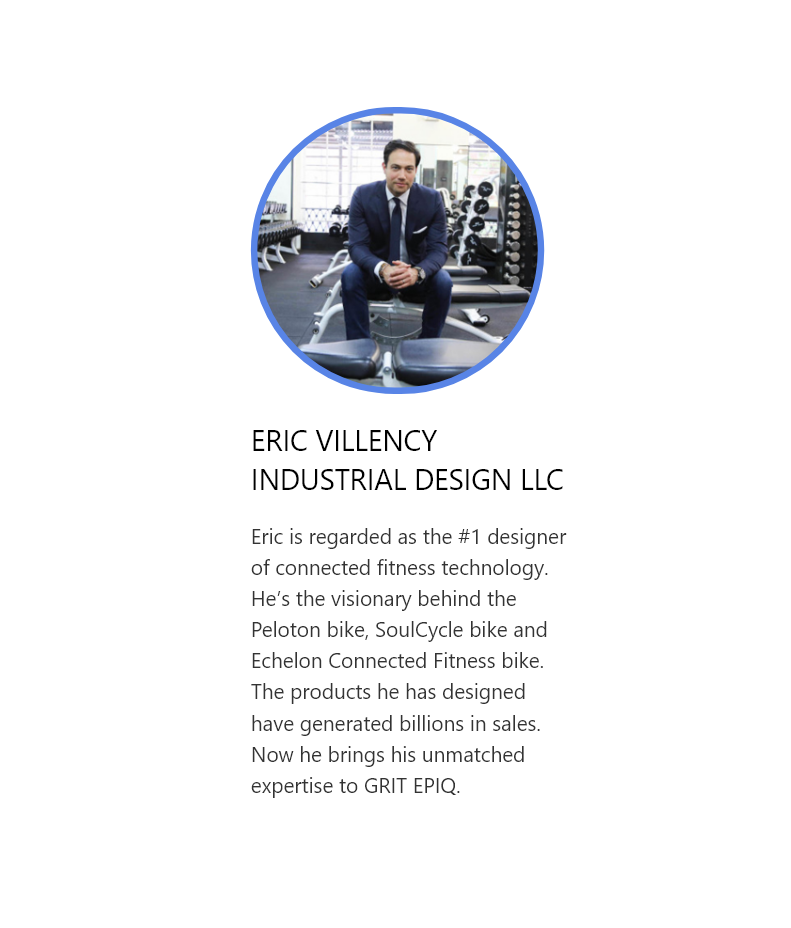

GRIT EPIQ is a revolutionary, all-in-one, AI-powered connected online fitness technology that was designed by the mastermind designer behind the Peloton bike: Eric Villency.

After GRIT’s parent company launched a physical fitness studio in New York City, in August 2019 called GRIT BXNG,

it quickly booked $2 million in gross revenues – and 70,000 reservations – in just seven months. But then in March 2020, the Covid-19 pandemic prompted a shift in its business plans, and it created its subsidiary, GRIT BXING At Home, to leverage its expertise in the growing online fitness market.

GRIT quickly reached out to World Class Fitness Designer Eric Villency to replicate his success with the Peloton bike and create a product with an at-home experience with an all-in-one product that no one else on the market has.

Who better to design an exciting, world-class at home digital fitness experience than Eric Villency, the mastermind designer behind the Peloton bike?

Inc. Magazine has named Eric Villency one of the most influential designers to watch and Well + Good called him “The wizard of wellness design” for his innovative work in the fitness industry.

Eric’s extensive work in the fitness industry includes Rumble Boxing, Barry’s Bootcamp, the SoulCycle bike, and the Peloton bike, which was named “best cardio machine on the planet” by Men’s Health. In addition, Eric has partnered with Echelon Fitness to assist in the design and development of future indoor fitness equipment.

With the rapidly-growing online fitness market still in its formative stages, investors now have a chance to take advantage of what could become the next breakthrough fitness design from Eric Villency.

Fitness Product Visionary Eric Villency

Inc. Magazine has named Eric Villency one of the most influential designers to watch and Well + Good called him “The wizard of wellness design” for his innovative work in the fitness industry.

Eric’s extensive work in the fitness industry includes Rumble Boxing, Barry’s Bootcamp, the SoulCycle bike, and the Peloton bike, which was named “best cardio machine on the planet” by Men’s Health. In addition, Eric has partnered with Echelon Fitness to assist in the design and development of future indoor fitness equipment.

With the rapidly-growing online fitness market still in its formative stages, investors now have a chance to take advantage of what could become the next breakthrough fitness design from Eric Villency.

Fitness Product Visionary Eric Villency

Inc. Magazine has named Eric Villency one of the most influential designers to watch and Well + Good called him “The wizard of wellness design” for his innovative work in the fitness industry.

Eric’s extensive work in the fitness industry includes Rumble Boxing, Barry’s Bootcamp, the SoulCycle bike, and the Peloton bike, which was named “best cardio machine on the planet” by Men’s Health. In addition, Eric has partnered with Echelon Fitness to assist in the design and development of future indoor fitness equipment.

With the rapidly-growing online fitness market still in its formative stages, investors now have a chance to take advantage of what could become the next breakthrough fitness design from Eric Villency.

Reason #3

GRIT IS DESIGNING

WHAT IT BELIEVES TO BE A WORLD-CLASS ONLINE FITNESS PRODUCT

Investors considering getting in early on GRIT should know that in order to be successful in the online fitness space, a company must be able to offer consumers a superior product. The success of companies like Peloton has clearly demonstrated that consumers are willing to pay for quality – and for a first-class, at-home fitness experience.

In this case, it’s important to know that the company is

designing what it believes will be the most complete

home gym on the market.

Much more than simply a piece of fitness equipment, GRIT EPIQ’s AI-powered breakthrough design is intended to be the most advanced, smartest all-in-one home fitness technology ever created. GRIT EPIQ is a total gym – the first of its kind that incorporates Artificial Intelligence with smart weights, smart knuckles and a smart mirror – unlike anything else available on the market today. AND it’s fun. Work out with a community of like-minded individuals and actually see who is on the other side of the screen.

In this case, it’s important to know that the company is

designing what it believes will be the most complete

home gym on the market.

Much more than simply a piece of fitness equipment, GRIT EPIQ’s AI-powered breakthrough design is intended to be the most advanced, smartest all-in-one home fitness technology ever created. GRIT EPIQ is a total gym – the first of its kind that incorporates Artificial Intelligence with smart weights, smart knuckles and a smart mirror – unlike anything else available on the market today. AND it’s fun. Work out with a community of like-minded individuals and actually see who is on the other side of the screen.

GRIT EPIQ prototype

- Artificial Intelligence that learns from your body,

tracks your progress

and makes workout recommendations. - Digital Smart Weights

make it easy to increase or decrease your dumbbells’ weight with the touch of a button. - Boxing knuckles which provide haptic vibration feedback, correcting

your punch form.

- An All-in-One Machine

that provides hundreds

of workouts from a digital reflective touch screen mirror display, which

houses a 2-way camera for community connections. - World Class Designed Bench that seemingly fits into any room in the home.

- High Energy, Motivational Trainers encourage you to push yourself through fun live and on demand classes.

- Versatile Class Types which

hit on every individual’s preferences from barre to Pilates to boxing to strength and conditioning – GRIT EPIQ

is your one stop shop for all

of your fitness needs. - Results Driven Workouts through algorithmic data which gives you a personalized GRIT IQ score, explaining how often you personally should workout, your daily strain, and improvements.

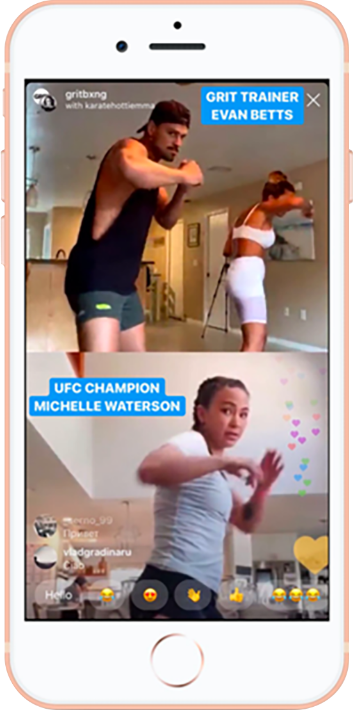

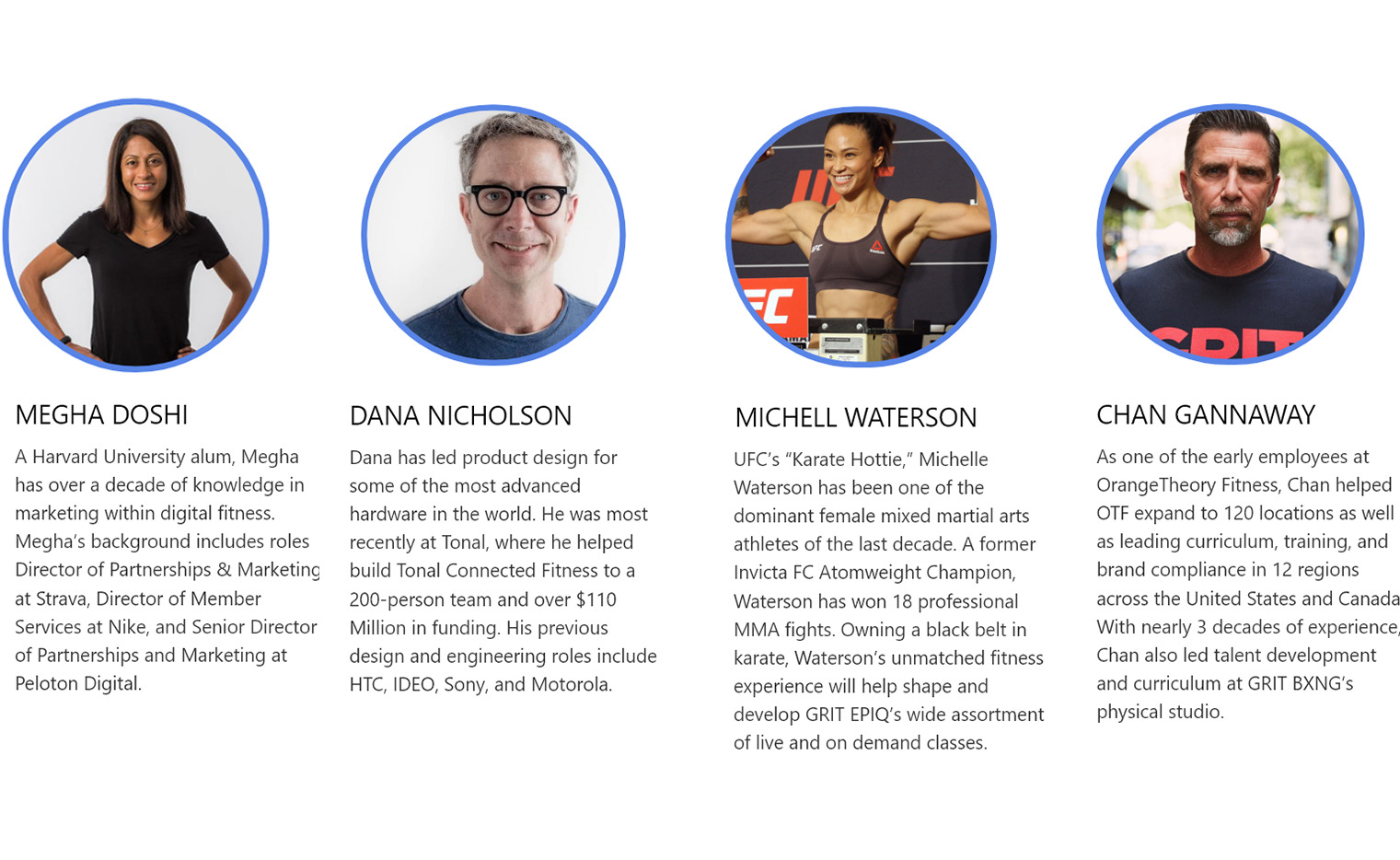

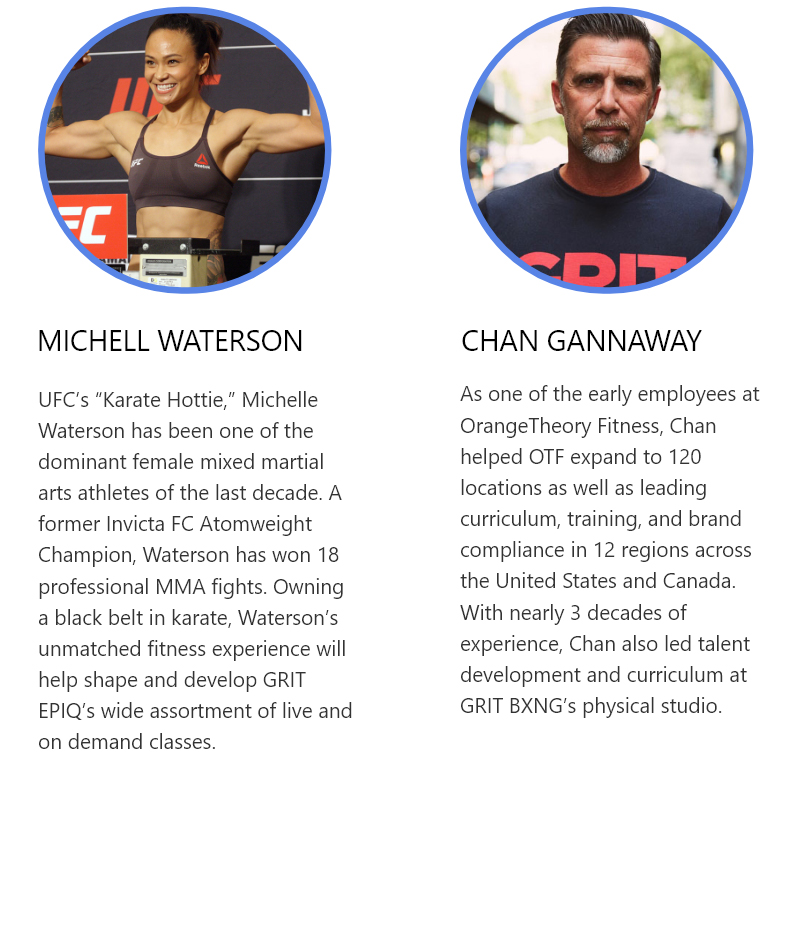

World Class trainers Evan Betts and Michelle Waterson, UFC Fighter

DISRUPT CONNECTED FITNESS:

• WORLD CLASS DESIGN

• INNOVATIVE TECHNOLOGY

• UNBELIEVABLE CONTENT

GRIT EPIQ gives its users direct access to a global workout community via live and on-demand classes, leaderboards and challenges. GRIT EPIQ is not just a workout platform, it’s a community fitness experience. Through the use of a 2-way camera to interact with friends and new users during your workouts, a virtual bar (yes, a virtual bar), receiving actual rewards for hitting milestones like GRIT swag, and lastly seminars and event nights, GRIT EPIQ is all about the community and fun.

Traditional at home workouts are boring, and it’s difficult to stay motivated to do them. But not GRIT EPIQ. GRIT EPIQ incentivizes you to keep working out with fun classes that fit anyone and everyone’s preferences. GRIT is anticipating shipping its revolutionary at-home experience to consumers in early 2022. GRIT EPIQ is being designed to be a revolutionary, all-in-one, AI-powered at-home connected fitness technology designed by the same person behind the Peloton bike.

Reason #4

GRIT EPIQ COULD BE THE NEXT GENERATION MODEL FOR THE CONNECTED FITNESS NICHE

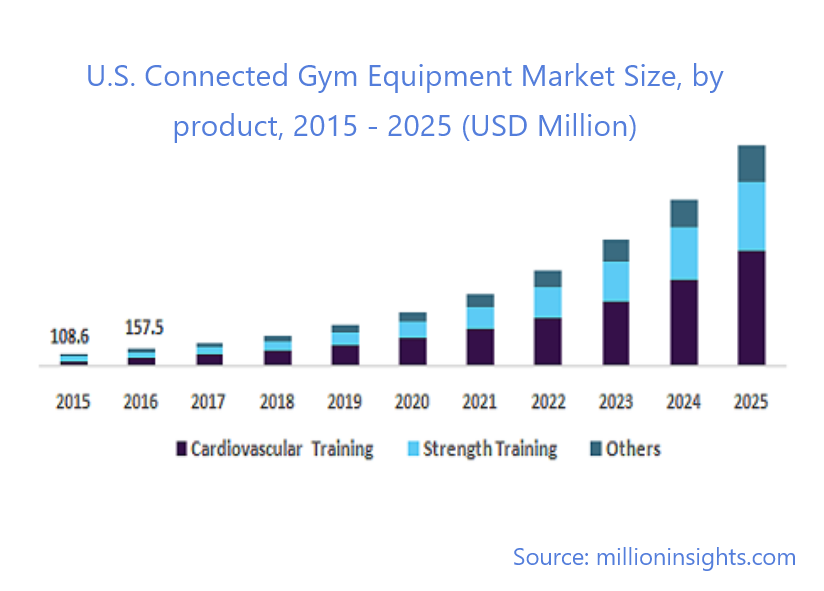

There’s no question that the fitness industry – valued at $96.7 billion in 2020 – has generated a number of truly astounding growth stories. And as the industry as a whole is continuing to grow, with experts projecting the fitness market to be worth $147 billion by 2024. Equally impressive is the 31.2% growth rate of the connected fitness niche to over $5 billion by 2025 as individuals turn toward connected fitness equipment to help better understand how to maximize their workouts during sessions.

With this growth over the next few years, companies bringing new innovation into the space could see significant growth. But the only way individual investors can get in without paying top dollar – as you would for companies like publicly traded companies like Peloton or Nautilus at this stage – is with an early stage opportunity.

GRIT intends to enter the connected fitness market space in a significant way. The GRIT EPIQ is being uniquely designed to stand out not only providing users with data and information on their performance, but provides unique recommendations based on that information. GRIT is in a position to enter the market at the beginning of this explosive growth.

GRIT is now offering individual investors an opportunity to get in on the ground floor with an early-stage investment in the rapidly-growing online and connected fitness market.

Reason #5

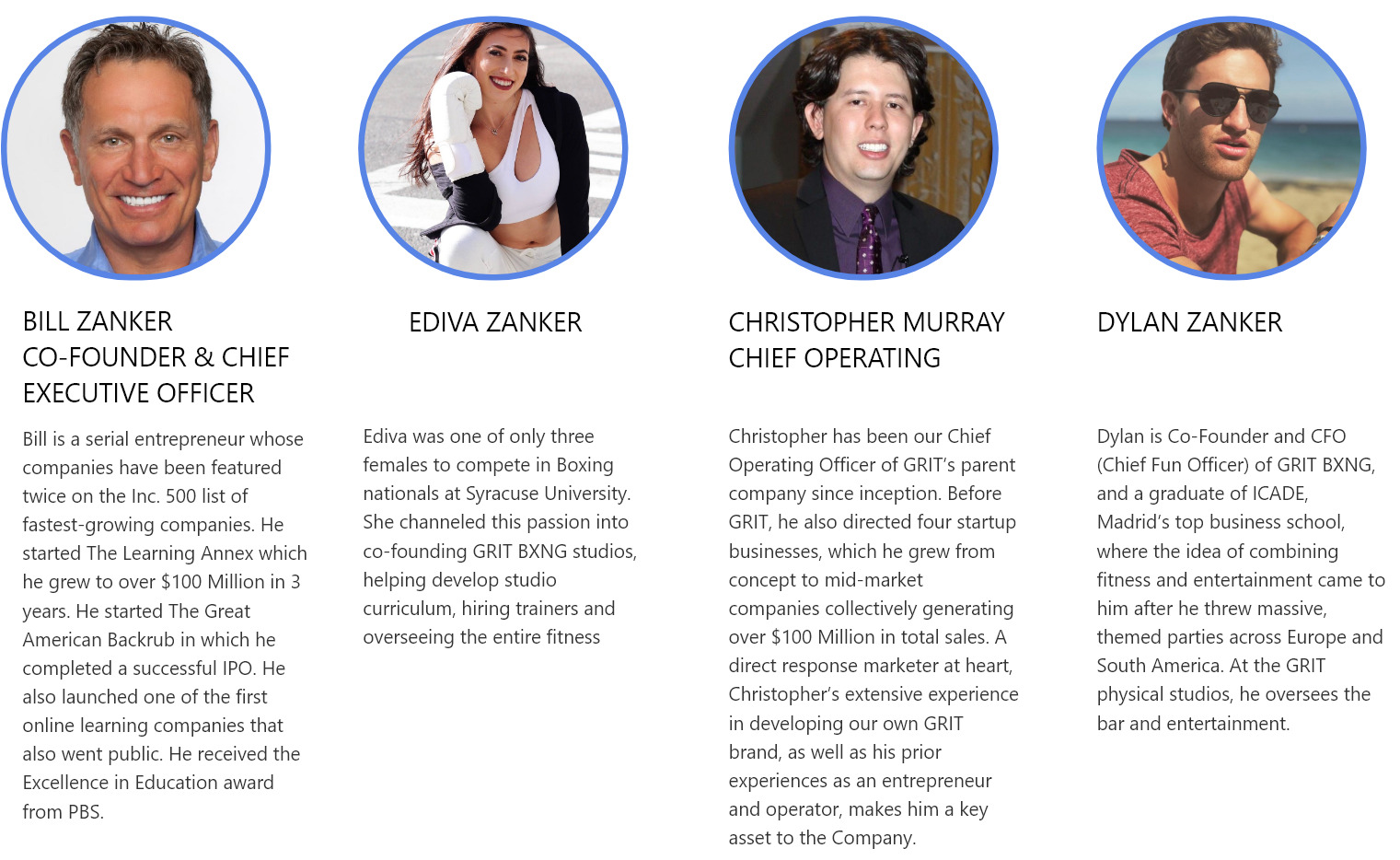

GRIT IS LED BY A PROVEN MANAGEMENT AND

ALL-STAR EQUITY TEAM

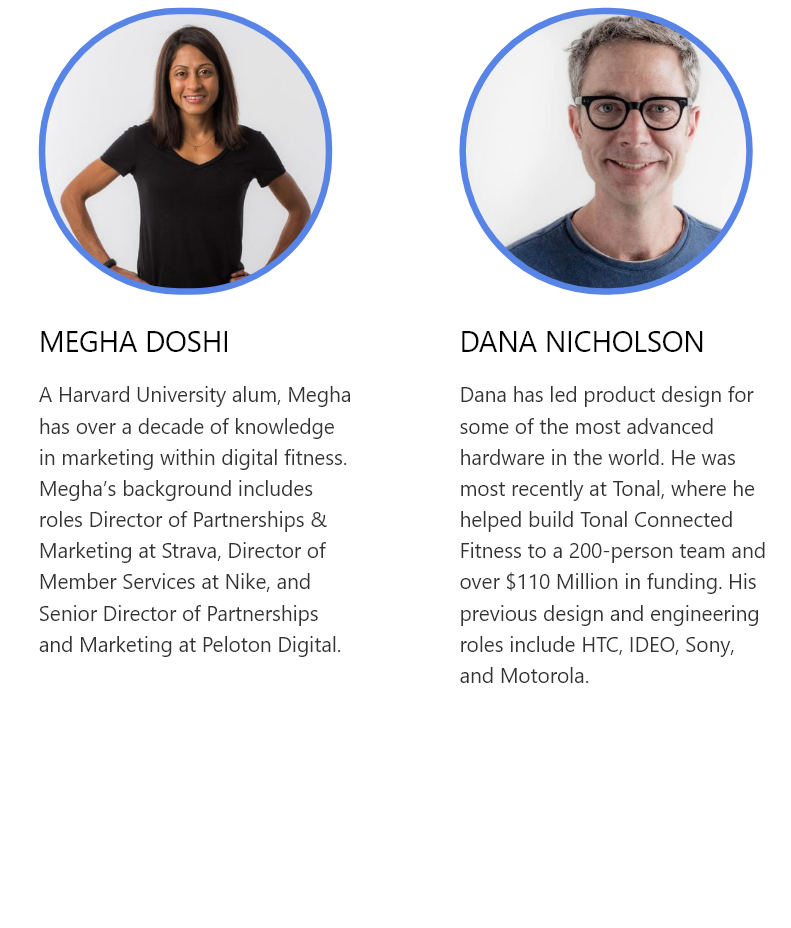

GRIT is led by a team of successful entrepreneurs and acclaimed business leaders including Bill Zanker, whose companies have twice been featured on the Inc. 500 list of the fastest-growing companies. And the company is backed by equity holders including life and business strategist Tony Robbins, Grammy Award winning musician and entrepreneur Pitbull and noted venture capital investor Tim Draper, among others.

This talented, successful group of strategic partners, advisors, GRIT equity holders and founders have come together to help make GRIT EPIQ an unqualified success for customers and GRIT a highly attractive investment opportunity for those looking to take advantage of the online fitness boom.

MEET THE GRIT TEAM:

MEET THE GRIT TEAM:

STRATEGIC PARTNERS

ADVISORY BOARD

FOUNDING TEAM

EQUITY HOLDERS

Risks Disclosure

We have not had any operations to date.

We were formed in Delaware in August 2020 as a limited liability company under the name GRIT BXNG AT HOME LLC and converted into a corporation on December 3, 2020. We are in the process of developing the GRIT BXNG At Home Product (the “Product”), our first product for which we have yet to build a working model. As such, we have not yet commenced any operations as an at-home interactive fitness platform and product company. We have not demonstrated our ability to overcome the risks frequently encountered in the interactive fitness industry and are subject to many of the risks common to early stage companies, including the uncertainty as to our ability to implement our business plan, create a viable product, market acceptance of our proposed business and services, under-capitalization, cash shortages, limitations with respect to personnel, financing and other resources and uncertainty of our ability to generate revenues, among others. There is no assurance that our activities will be successful or will result in any revenues or profit, and the likelihood of our success must be considered, given the current stage of our development. There can be no assurance that we will be able to consummate our business strategy and plans, or that we will not be subject to financial, technological, market, or other limitations that may force us to modify, alter, significantly delay, significantly impede, or terminate the implementation of such plans. We have no current or prior operating results for investors to use to identify historical trends. Investors should consider our prospects in light of the risks, expenses, and difficulties we will encounter as an early stage company. Our revenue and income potential are unproven, and our business model is continually evolving. We are subject to the risks inherent to the operation of a new business enterprise and cannot assure you that we will be able to successfully address these risks.

Our planned product has not yet been developed, and even if developed, an interest in it may not develop.

We have entered into a Product Development Agreement (the “Product Development Agreement”) with Industrial Design, LLC (“Industrial Design”), to design a GRIT BXNG At Home high tech full body workout device or devices. There can be no assurance that the Product or the anticipated features or services included in the Product will create substantial interest or a market, that the manufacturable design for the Product will adhere to the terms and specifications in the Product Development Agreement, and therefore our anticipated product, its sales and subscriber growth for our product or services may not develop as expected, or at all. Even if such a market for the Product develops, there can be no assurance that we would be able to maintain that market. Our continued business and revenue growth will be dependent on our ability to continuously attract and retain customers and subscribers, and we cannot be sure that we will be successful in these efforts, or that customer or subscriber retention levels will not materially decline. There are a number of factors that could lead to a decline in customer or subscriber levels or that could prevent us from in obtaining customers or subscribers, including:

● unanticipated delays in the development or shipment of the Product or the inability to build a working prototype of our product;

● our failure to introduce new features, products, or services that customers find engaging or our introduction of new products or services, or changes to existing products and services that are not favorably received;

● harm to our brand and reputation;

● pricing and perceived value of our offerings;

● our inability to deliver quality products, content, and services;

● our customers or subscribers engaging with competitive products and services;

● technical or other problems preventing our customers or subscribers from accessing our content and services in a rapid and reliable manner or otherwise affecting their experience;

● unsatisfactory experiences with the delivery, installation, or service of our products;

● a decline in the public’s interest in at-home connected fitness equipment, boxing or other fitness disciplines that we invest most heavily in;

● deteriorating general economic conditions or a change in consumer spending preferences or buying trends; and

● the trend of consumers toward traditional gyms and fitness studios. Additionally, any attempt at expansion into international markets such as Canada, the United Kingdom, and Germany will create new challenges in attracting and retaining customers or subscribers that we may not successfully address. As a result of these factors, we cannot be sure that our customer or subscriber levels will be adequate to maintain or permit the expansion of our operations. An inability to grow our customer or subscriber base could have an adverse effect on our business, financial condition and operating results.

We may be unable to secure the resources, distribution channels and delivery methods should purchase orders for the Product development exceed capacity.

Even if an interest and market in the Product develops, our success will be dependent upon our ability to secure manufacturers, raw materials, distribution channels and establish a sales and marketing team to meet any anticipated growth in sales and subscribers. We currently have no agreements with any such suppliers or manufacturers, and even if such agreements were secured, there can be no assurance that such partners would meet our anticipated or unanticipated needs.

To date we have not been profitable and there can be no guarantee that we will be profitable in the future.

We expect to incur operating losses for the foreseeable future until such time as we develop interest and market in the Product. Our ability to achieve profitability will depend, upon other things upon our ability to successfully develop interest and market in the Product and the general economic conditions. There can be no assurance that we will ever generate significant sales or achieve profitability. Accordingly, the extent of future losses and the time required to achieve profitability, if ever, may not be as anticipated.

We may need to raise additional capital that may be required to grow our business, and we may not be able to raise capital on terms acceptable to us or at all.

Operating our business and maintaining our growth efforts will require significant cash outlays and advance capital expenditures and commitments. If cash on hand and cash generated from operations and from this offering are not sufficient to meet our cash requirements, we will need to seek additional capital, potentially through debt or equity financings, to fund our growth. We cannot assure you that we will be able to raise needed cash on terms acceptable to us or at all. Financings may be on terms that are dilutive or potentially dilutive to our stockholders, and the prices at which new investors would be willing to purchase our securities may be lower than the price per share of our common stock in this offering. The holders of new securities may also have rights, preferences or privileges which are senior to those of existing holders of common stock. If new sources of financing are required, but are insufficient or unavailable, we will be required to modify our growth and operating plans based on available funding, if any, which would harm our ability to grow our business.

Additional Risk Disclosures

We have limited financial and other information upon which an investor can base their decision.

Inasmuch as we have recently just begun the development of the Product and therefore our operations are severely limited at the moment, and have yet to generate any revenue, we have limited financial information upon which you can base your investment decision. Our audited financial statements as of October 31, 2020, primarily reflect the fact that we’ve had no operations to date. Therefore, the audited financial statements as of October 31, 2020, should not be relied upon as an indication of our future operations.

We will have limited control over our suppliers, manufacturers, and logistics partners, which may subject us to significant risks, including the potential inability to produce or obtain quality products and services on a timely basis or in sufficient quantity.

We will likely have limited control over our suppliers, manufacturers, and logistics partners, which subjects us to risks, such as the following:

● inability to satisfy demand for the Product;

● reduced control over delivery timing and product reliability;

● reduced ability to monitor the manufacturing process and components used in the Product;

● limited ability to develop comprehensive manufacturing specifications that take into account any materials shortages or substitutions;

● variance in the manufacturing capability of our third-party manufacturers;

● price increases;

● failure of a significant supplier, manufacturer, or logistics partner to perform its obligations to us for technical, market, or other reasons;

● variance in the quality of last mile services provided by our third-party logistics partners;

● difficulties in establishing additional supplier, manufacturer, or logistics partner relationships if we experience difficulties with our existing suppliers, manufacturers, or logistics partners;

● shortages of materials or components;

● misappropriation of our intellectual property;

● exposure to natural catastrophes, political unrest, terrorism, labor disputes, and economic instability resulting in the disruption of trade from foreign countries in which the Product is manufactured or the components thereof are sourced;

● changes in local economic conditions in the jurisdictions where our suppliers, manufacturers, and logistics partners are located;

● the imposition of new laws and regulations, including those relating to labor conditions, quality and safety standards, imports, duties, tariffs, taxes, and other charges on imports, as well as trade restrictions and restrictions on currency exchange or the transfer of funds; and

● insufficient warranties and indemnities on components supplied to our manufacturers or performance by our partners. The occurrence of any of these risks, especially during seasons of peak demand, could cause us to experience a significant disruption in our ability to produce and deliver our products to our customers.

The market for our planned product and services is still in the early stages of growth and if it does not continue to grow, grows more slowly than we expect, or fails to grow as large as we expect, our business, financial condition, and operating results may be adversely affected.

The at-home interactive fitness market is a relatively new and rapidly growing market that is largely unproven, and it is uncertain whether it will sustain high levels of demand and achieve wide market acceptance. There has been a rapid movement toward at-home fitness equipment, including those described as “connected” fitness equipment, such as Peloton’s equipment, due to the outbreak of the COVID-19 epidemic and stay-at-home orders across the United States and around the world. Our success depends substantially on the willingness of consumers to widely adopt our products and services in the long term, which are largely unknown to date. To be successful, we will have to educate consumers about our products and services through significant investment and provide quality content that is superior to the content and experiences provided by our competitors. Additionally, the at-home interactive fitness market at large is saturated, and the demand for and market acceptance of new products and services in the market is uncertain. It is difficult to predict the future growth rates, if any, and size of our market. We cannot assure you that our market will develop, that the public’s interest in at-home interactive fitness will continue, or that our products and services will be widely adopted. If our market does not develop, develops more slowly than expected, or becomes more saturated with competitors, or if our products and services do not achieve market acceptance, our business, financial condition, and operating results could be adversely affected.

We operate in a highly competitive market and we may be unable to compete successfully against existing and future competitors.

Our products and services will be offered in a highly competitive market. We will face significant competition in every aspect of our business, including at-home fitness equipment and content and health and wellness apps that we may develop in the future or concurrently with our product. Moreover, we expect the competition in our market to intensify in the future as new and existing competitors introduce new or enhanced products and services that compete with ours, particularly during this consumer shift to at-home fitness due to the COVID-19 pandemic outbreak. Our competitors may develop, or have already developed, products, features, content, services, or technologies that are similar to ours or that achieve greater acceptance, may undertake more successful product development efforts, create more compelling employment opportunities, or marketing campaigns, or may adopt more aggressive pricing policies. Our competitors may develop or acquire, or have already developed or acquired, intellectual property rights that significantly limit or prevent our ability to compete effectively in the public marketplace. In addition, our competitors may have significantly greater resources than us or have a first-to-market advantage, allowing them to identify and capitalize more efficiently upon opportunities in new markets and consumer preferences and trends, quickly transition and adapt their products and services, devote greater resources to marketing and advertising, or be better positioned to withstand substantial price competition. If we are not able to compete effectively against our competitors, they may acquire and engage customers or generate revenue at the expense of our efforts, which could have an adverse effect on our business, financial condition, and operating results.

Our consolidated financial statements have been prepared assuming that we will continue as a going concern.

Our operating losses, negative cash flows from operations, and limited alternative sources of revenue, raise substantial doubt about our ability to continue as a going concern. Our consolidated financial statements as of October 31, 2020 do not include any adjustments that might result from the outcome of this uncertainty. If we cannot raise adequate capital on acceptable terms or at all, or generate sufficient revenue from operations, we will need to revise our business plans.

We have experienced operating losses to date and expect to continue to generate operating losses and experience negative cash flows and it is uncertain whether we will achieve profitability.

As of October 31, 2020, we incurred a net loss of $22,916. We expect to incur operating losses until such time, if ever, as we are able to achieve sufficient levels of revenue from sales and subscriptions. There can be no assurance that we will ever generate significant revenue or achieve profitability. Accordingly, the extent of future losses and the time required to achieve profitability, if ever, cannot be predicted at this point. Our operating results for future periods are subject to numerous uncertainties and there can be no assurances that we will be profitable in the foreseeable future, if at all. If our revenues decrease in a given period, we may be unable to reduce operating expenses which could materially and adversely affect our business and, therefore, our results of operations and lead to a net loss (or a larger net loss) for that period and subsequent periods. We also expect to experience negative cash flows for the foreseeable future as we anticipate increased expenses related to product development, manufacturing, marketing and deliveries. As a result, we will need to generate significant revenues or raise additional financing in order to achieve and maintain profitability and finance the expansion of our operations. We may not be able to generate these revenues or achieve profitability in the future, or maintain profitability once achieved. Our failure to achieve or maintain profitability would likely negatively impact the value of our securities and financing activities.

If we fail to comply with applicable privacy, security, and data laws, regulations and standards, our business could be materially and adversely affected.

We intend to use electronic mail (“email”), text messages, chat message services and phone calls to market our services to potential customers. The laws and regulations governing the use of telephonic communication, including but not limited to emails, text messages and phone calls, for commercial purposes continue to evolve. Because messaging and phone calls will be important to our business, if we are unable to successfully deliver messages or make phone calls to existing customers and potential customers, if there are legal restrictions on delivering these messages to consumers, or if consumers do not or cannot receive our messages or phone calls, our revenues and profitability could be adversely affected. If new laws or regulations are adopted, or existing laws and regulations are interpreted, to impose additional restrictions on our ability to call or send email or text messages to our customers or potential customers, we may not be able to communicate with them in a cost-effective manner and it may limit our ability to utilize such forms of communication. In addition to legal restrictions on the use of emails, text messages and phone calls for commercial purposes, service providers and others attempt to block the transmission of unsolicited messages, commonly known as “spam.” Many service providers have relationships with organizations whose purpose it is to detect and notify the service providers of entities that the organization believes is sending unsolicited messages. If a service provider identifies messaging from us as “spam” as a result of reports from these organizations or otherwise, we could be placed on a restricted list that will block our messages to customers or potential customers. If we are restricted or unable to communicate through emails, text messages or phone calls with our customers and potential customers as a result of legislation, regulation, blockage or otherwise, our business, operating results and financial condition could be adversely affected.

Security and privacy breaches may expose us to liability and cause us to lose customers.

We are subject to government regulation, and changes in these regulations could have a negative effect on our financial condition and results of operations.

Our operations and business practices are subject to federal, state and local government regulation in the various jurisdictions in which the Product is sold, including, but not limited to the following:

● general rules and regulations of the Federal Trade Commission;

● rules and regulations of state and local consumer protection agencies;

● federal and state laws and regulations governing privacy and security of information; and

● state and local health regulations. Any changes in such laws or regulations could have a material adverse effect on our financial condition and results of operations.

Changes in legislation or requirements related to electronic fund transfer, or our failure to comply with existing or future regulations, may adversely impact our business.

We intend to primarily accept payments for our apps through EFT from customers’ bank accounts and, therefore, will be subject to federal, state and provincial legislation and certification requirements governing EFT, including the Electronic Funds Transfer Act, and compliance with these laws and regulations and similar requirements may be onerous and expensive. In addition, variances and inconsistencies from jurisdiction to jurisdiction may further increase the cost of compliance and doing business. States that have such statutes provide harsh penalties for violations. Our failure to comply fully with these rules or requirements may subject us to fines, higher transaction fees, penalties, damages and civil liability and may result in the loss of our ability to accept EFT payments, which would have a material adverse effect on our business, results of operations and financial condition. In addition, any such costs, which may arise in the future as a result of changes to the legislation and regulations or in their interpretation, could individually or in the aggregate cause us to change or limit our business practice, which may make our business model less attractive to our customers.

We will be subject to a number of risks related to ACH, credit card and debit card payments we accept.

We intend to accept payments through automated clearing house (“ACH”), credit card and debit card transactions. For ACH, credit card and debit card payments, we will pay interchange and other fees, which may increase over time. An increase in those fees would require us to either increase the prices we charge for our apps, which could cause us to lose customers, or suffer an increase in our operating expenses, either of which could harm our operating results. If we or any of our processing vendors have problems with our billing software, or the billing software malfunctions, it could have an adverse effect on our customer satisfaction and could cause one or more of the major credit card companies to disallow our continued use of their payment products. In addition, if our billing software fails to work properly and, as a result, we do not automatically charge our customers’ credit cards, debit cards or bank accounts on a timely basis or at all, we could lose customers revenue, which would harm our operating results. If we fail to adequately control fraudulent ACH, credit card and debit card transactions, we may face civil liability, diminished public perception of our security measures, and significantly higher ACH, credit card and debit card related costs, each of which could adversely affect our business, financial condition and results of operations. The inability to utilize any of these payment methods, or the termination of our ability to process payments through ACH transactions or on any major credit or debit card would significantly impair our ability to operate our business.

There is no guarantee that we will raise the Maximum Offering Amount in this Offering.

Our goal is to raise the Maximum Offering Amount in this Offering, but there is no guarantee that we will be successful in raising that amount. If we do not raise the Maximum Offering Amount, we will likely have to review our plans for using the net proceeds from this Offering and reallocate the ways in which the net proceeds will be used. We will have broad discretion in reallocating the use of the net proceeds and you may not approve of the ways the net proceeds are used.

Our management has broad discretion to determine how to use the proceeds received from this Offering and may use them in ways that may not enhance its operating results or the price of the Shares.

We plan to use the net proceeds of the Offering to fund the designing and manufacturing of the Product and for marketing and hiring expenses. Our management will have broad discretion over the use and investment of the net proceeds of the Offering, and accordingly investors in the Offering will need to rely upon the judgment of our management with respect to the use of proceeds with only limited information concerning management’s specific intentions. It is possible that we may decide in the future not to use the proceeds of the Offering in the manner in which we currently expect.

Our Offering is being conducted on a “best efforts” basis and does not require a minimum amount to be raised. As a result, we may not be able to raise enough funds to fully implement our business plan and our investors may lose their entire investment.

This Offering is on a “best efforts” basis and does not require a minimum amount to be raised. If we are not able to raise sufficient funds, we may not be able to fund our operations as planned, and our growth opportunities may be materially adversely affected. This could increase the likelihood that an investor may lose their entire investment.

We have inadequate capital and need additional financing to accomplish our business and strategic plans.

We have very limited funds, and such funds are not adequate to develop our current business plan. At October 31, 2020, our cash balance was $3,317. We believe that for us to be successful, we will be required to spend a significant amount of capital to build and market our product. If the revenue derived from operations is not as anticipated, our ultimate success may depend on our ability to raise additional capital. In the absence of additional financing or significant revenues and profits, we will have to approach our business plan from a much different and much more restricted direction, attempting to secure additional funding sources to fund our growth which could include borrowings, private offerings, public offerings, or some type of business combination, such as a merger, or buyout. In addition, any future sale of our convertible securities or equity securities, if created, would dilute the ownership of your Shares and could be at prices substantially below prices at which the Shares have previously been sold. Our inability to raise capital could require us to significantly curtail or terminate our operations, as well as negatively impact our ability to repay any debt obligations upon maturity, if any. The incurrence of indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations and liquidity. In addition, our ability to obtain additional capital on acceptable terms, if at all, is subject to a variety of uncertainties. We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all. Any failure to raise additional funds on favorable terms could have a material adverse effect on our liquidity and financial condition.

Our growth could place strains on our management, employees, information systems and internal controls, which may adversely impact our business.

Once we develop our product, our manufacturing expansion, if necessary, will place significant demands on our management resources. We will be required to identify partners to manufacture the Product, negotiate favorable terms and market the Product, and develop a sales strategy and distribution channel on a timely and cost-effective basis while maintaining a high level of quality, efficiency and performance, while also protecting our brand name with customer service and assessing feedback to further improve the Product. In addition, we will need to continue to implement management information systems and improve our operating, administrative, financial and accounting systems and controls. We will also need to recruit, train and retain new instructors for original content, and other employees and maintain close coordination among our executive, accounting, finance, marketing, sales and operations functions. These processes are time-consuming and expensive and may divert management’s attention. We may not be able to effectively manage this growth, and any failure to do so could have a material adverse effect on our rate of growth, business, financial condition and results of operations.

We are dependent on our Chief Executive Officer. In addition, the loss of key personnel and/or failure to attract and retain highly qualified personnel could make it more difficult for us to develop our business and enhance our financial performance.

We are dependent on the continued services of our senior management team, including our CEO William Zanker, who has created our business strategy and has the relationships with our parent company’s celebrity endorser and social media influencers. We believe the loss of one or any of our senior management team, particularly Mr. Zanker, could have a material adverse effect on us and our financial performance. Currently, we do not have any long-term employment agreements with our executive officers, and we may not be able to attract and retain sufficient qualified personnel to meet our business needs. We may not be successful in attracting and retaining the personnel we require to develop and market our product or services. The loss of one or more of our key employees or our inability to attract, retain and motivate qualified personnel could negatively impact our ability to design, develop, manufacture and market our product.

Our management team has no experience in the operation of an at-home fitness equipment company.

Although, our management team, in particular our Chief Executive Officer, has held many senior management positions at other companies, neither he, nor the other members of management, have in the past operated a fitness equipment company. However, the Company expects to recruit executives and other employees with experience in the at-home fitness market and also expects the Company’s existing experience in running a popular boutique fitness studio in New York City to translate well into the at-home fitness industry. The lack of direct experience by our current management team in at-home fitness could nevertheless adversely affect the success of our business and there can be no guarantee that the Company will be able to hire experienced personnel on reasonable and favorable terms, or at all.

Our management team will provide services for our parent company and therefore, their time and attention may be divided between the operations of Work Hard and the Company.

Our management team will provide services for our parent company and therefore, their time and attention may be divided between the operations of Work Hard and the Company. While we expect our management team to provide an adequate amount of attention on the Company’s operations, they will not be devoting their full time and attention to our business. Further, there can be no assurance that conflicts of interest will not arise with respect to our business and that of our parent company, or those of the other business ventures in which our management team is engaged, or that any conflicts will be resolved in a manner favorable to us.

We are dependent upon affiliated parties for the provisions of a substantial portion of our administrative services as we do not have the internal capabilities to provide such services, and many of our employees are also employees of such affiliated entities.

We intend to use the office space, office equipment, personnel, financial analysis personnel, and assorted other services related to our day-to-day operations and our efforts of our parent company. There can be no assurance that we can successfully develop the necessary infrastructure on our own without the assistance of these affiliated entities.

The market for our planned product and services is still in the early stages of growth and if it does not continue to grow, grows more slowly than we expect, or fails to grow as large as we expect, our business, financial condition, and operating results may be adversely affected.

The at-home interactive fitness market is a relatively new and rapidly growing market that is largely unproven, and it is uncertain whether it will sustain high levels of demand and achieve wide market acceptance. There has been a rapid movement toward at-home fitness equipment, including those described as “connected” fitness equipment, such as Peloton’s equipment, due to the outbreak of the COVID-19 epidemic and stay-at-home orders across the United States and around the world. Our success depends substantially on the willingness of consumers to widely adopt our products and services in the long term, which are largely unknown to date. To be successful, we will have to educate consumers about our products and services through significant investment and provide quality content that is superior to the content and experiences provided by our competitors. Additionally, the at-home interactive fitness market at large is saturated, and the demand for and market acceptance of new products and services in the market is uncertain. It is difficult to predict the future growth rates, if any, and size of our market. We cannot assure you that our market will develop, that the public’s interest in at-home interactive fitness will continue, or that our products and services will be widely adopted. If our market does not develop, develops more slowly than expected, or becomes more saturated with competitors, or if our products and services do not achieve market acceptance, our business, financial condition, and operating results could be adversely affected.

The success of our business depends on our ability to retain the value of our brands.

Our ability to maintain our brand image and reputation will be integral to our business. Maintaining, promoting and growing our brand will depend largely on the success of our marketing efforts and our ability to provide a consistent, high-quality customer experience. Our reputation could be jeopardized if we fail to maintain high standards for customer experience, fail to maintain high ethical, social, and environmental standards for all of our operations and activities, or if we fail to appropriately respond to concerns associated with any of the foregoing or any other concerns from our customers. We could be adversely impacted if we or our parent company fails to achieve any of these objectives or if the reputation or image of any of our or our parent company’s brands are tarnished or receive negative publicity. In addition, adverse publicity about regulatory or legal action against us, our parent company or by us, could damage our reputation and brand image. Damage to our reputation or loss of consumer confidence for any of these reasons may result in fewer customers, which in turn could materially and adversely affect our results of operations and financial condition.

Our expectation is that we may depend on a limited number of suppliers for equipment and certain products and services could result in disruptions to our business and could adversely affect our revenues and gross profit.

Raw materials and certain other services to be used in the Product, including the hardware and software to be included in the Product, are expected to be sourced from third-party suppliers. Although we believe that adequate substitutes are currently available, we will be dependent upon these third-party suppliers to operate our business efficiently and consistently meet our business requirements. The ability of these third-party suppliers to successfully provide reliable and high-quality services is subject to technical and operational uncertainties that are beyond our control, including, for our overseas suppliers, vessel availability and port delays or congestion. Any disruption to our suppliers’ operations could impact our supply chain and our ability to service our existing stores and open new studios on time or at all and thereby generate revenue. If we lose such suppliers or our suppliers encounter financial hardships unrelated to the demand for our equipment or other products or services, we may not be able to identify or enter into agreements with alternative suppliers on a timely basis on acceptable terms, if at all. Transitioning to new suppliers would be time consuming and expensive and may result in interruptions to our operations. If we should encounter delays or difficulties in securing the quantity of equipment we require to open new and refurbish existing studios, our suppliers encounter difficulties meeting our demands for products or services, our websites experience delays or become impaired due to errors in the third-party technology or there is a deficiency, lack or poor quality of products or services provided, our ability to serve our customers and grow our brand would be interrupted. If any of these events occur, it could have a material adverse effect on our business and operating results.

Our trademarks and trade names may be infringed, misappropriated or challenged by others.

We believe our brand names and those of our parent company are important to our business. We seek to protect our trademarks, trade names and other intellectual property by exercising our rights under applicable trademark and copyright laws. If we were to fail to successfully protect our intellectual property rights for any reason, it could have an adverse effect on our business, results of operations and financial condition. Any damage to our reputation could cause customer levels to decline and make it more difficult to attract new customers.

Use of social media may adversely impact our reputation or subject us to fines or other penalties.

There has been a substantial increase in the use of social media platforms, including blogs, social media, websites and other forms of internet-based communication, which allow individuals access to a broad audience of consumers and other interested persons. Negative commentary about us or our parent company may be posted on social media platforms or similar devices at any time and may harm our reputation or business. The harm may be immediate without affording us an opportunity for redress or correction. In addition, social media platforms provide users with access to such a broad audience that collective action against the Product and services, such as boycotts, can be more easily organized. If such actions were organized, we could suffer reputational damage as well as physical damage to our stores. We also intend to use social medial platforms as marketing tools. For example, we intend to maintain Facebook and other social media accounts. As laws and regulations rapidly evolve to govern the use of these platforms and devices, the failure by us, our employees or third parties acting at our direction to abide by applicable laws and regulations in the use of these platforms and devices could adversely impact our business, financial condition and results of operations or subject us to fines or other penalties.

We are dependent upon the public image of our parent company’s celebrity investors and spokespersons and any negative publicity regarding such celebrity investors or spokespersons could have a negative effect on our business.

If there is any negative publicity about the celebrity investors and spokespersons for our parent company, the negative publicity could have an adverse impact on our business. A large part of our marketing plan of our parent company has revolved around our parent company’s public image in the region in which Work Hard has a fitness studio. Currently, Pitbull and Tony Robbins are celebrity investors in our parent company and Pitbull is a celebrity spokesperson for our parent company.

We will rely on mobile operating systems and application marketplaces to make our apps available to our customers, and if we do not effectively operate with or receive favorable placements within such application marketplaces and maintain high customer reviews, our usage or brand recognition could decline and our business, financial results and results of operations could be adversely affected.

We will depend in part on mobile operating systems, such as Android and iOS, and their respective application marketplaces to make our apps available to customers. Any changes in such systems and application marketplaces that degrade the functionality of our apps or give preferential treatment to our competitors’ apps could adversely affect our platform’s usage on mobile devices or the Product’s internal operating system. If such mobile operating systems or application marketplaces limit or prohibit us from making our apps available to customers, make changes that degrade the functionality of our apps, increase the cost of using our apps, impose terms of use unsatisfactory to us or modify their search or rating algorithms in ways that are detrimental to us, or if our competitors placement in such mobile operating systems application marketplace is more prominent than the placement of our apps, overall growth in our customer base could slow. Any of the foregoing risks could adversely affect our business, financial condition and results of operations. As new mobile devices and mobile platforms are released, there is no guarantee that certain mobile devices will continue to support our platform or effectively roll out updates to our app. Additionally, in order to deliver a high-quality app, we need to ensure that our offerings are designed to work effectively with a range of mobile technologies, systems, networks and standards. We may not be successful in developing or maintaining relationships with key participants in the mobile industry that enhance customers’ experience. If customers encounter any difficulty accessing or using our apps on their mobile devices or if we are unable to adapt to changes in popular mobile operating systems, our business, financial condition and results of operations could be adversely affected.

We could be subject to claims related to health or safety risks.

Use of the Product and/or services will pose some potential health or safety risks to customers through physical exertion and use of their product or services. Claims might be asserted against us for injury suffered by, or death of customers or guests while using the Product. We might not be able to successfully defend such claims. As a result, we might not be able to maintain our general liability insurance on acceptable terms in the future or maintain a level of insurance that would provide adequate coverage against potential claims. Depending upon the outcome, these matters may have a material effect on our consolidated financial position, results of operations and cash flows.

Regulatory changes in the terms of credit and debit card usage, including any existing or future regulatory requirements, could have an adverse effect on our business.

Our business will rely heavily on the use of credit and debit cards in sales transactions. Regulatory changes to existing rules or future regulatory requirements affecting the use of credit and debit cards or the fees charged could impact the consumer and financial institutions that provide card services. This may lead to an adverse impact on our business if the regulatory changes result in unfavorable terms to either the consumer or the banking institutions.

Disruptions and failures involving our information systems could cause customer dissatisfaction and adversely affect our billing and other administrative functions.

The continuing and uninterrupted performance of our information systems will be critical to our success. We intend to use a fully integrated information system to process new customer information, and track and analyze sales and customer statistics, the frequency and timing of customer workouts, customer life, value-added services and demographic profiles by customers. This system will also assist us in evaluating staffing needs and program offerings. Correcting any disruptions or failures that affect our proprietary system could be difficult, time-consuming and expensive, because we would need to use contracted consultants familiar with our system. Any failure of our system could also cause us to lose customers and adversely affect our business and results of operations. Our customers may become dissatisfied by any system disruptions or failure that interrupts our ability to provide our services to them. Disruptions or failures that affect our billing and other administrative functions could have an adverse effect on our operating results. Fire, floods, earthquakes, power loss, telecommunications failures, break-ins, acts of terrorism, pandemics, further lockdowns preventing us from developing, manufacturing, or shipping the Product, and similar events could damage our systems. In addition, computer viruses, electronic break-ins or other similar disruptive problems could also adversely affect our sites and systems. Any system disruption or failure, security breach or other damage that interrupts or delays our operations could cause us to lose customers, damage our reputation, and adversely affect our business and results of operations.

Investors in this Offering will experience immediate and substantial dilution in the book value of their investment.

The Offering Price of our Shares will be substantially higher than the net tangible book value per Share of our outstanding shares of common stock immediately prior to the Offering. Therefore, if you purchase Shares in the Offering, you will incur an immediate dilution.

An investment in our securities is highly illiquid.

It will be very difficult for an investor to sell our securities to a third-party until a market for our securities develops, of which there can be no assurance. Investors must therefore be prepared to bear the economic risk of an investment in the Shares for an indefinite period of time. The exit strategy for investors or liquidity event will only occur if an event such as the sale of our company, a full public offering onto an exchange or national exchange, or a complete refinancing of the business occurs, among other potential events. If you require liquidity in your investments, you should not invest in the Shares.

Future sales of our securities will dilute the ownership interest of our current stockholders.

We may sell additional equity securities in order to raise the funds necessary to expand our operations. Any such transactions will involve the issuance of our previously authorized and unissued securities and will result in the dilution of the ownership interests of our present stockholders.

Anti-takeover provisions in our charter documents and under Delaware law may make an acquisition of us more complicated and may make the removal and replacement of our directors and management more difficult.

Our certificate of incorporation, as amended, and bylaws contain provisions that may delay or prevent a change in control, discourage bids at a premium over the market price of our common stock and adversely affect the market price of our common stock and the voting and other rights of the holders of our common stock. These provisions may also make it difficult for stockholders to remove and replace our board of directors and management. These provisions:

● authorize the issuance of “blank check” preferred stock that could be issued by our board of directors to increase the number of outstanding shares and prevent or delay a takeover attempt; and

● limit who may call a special meeting of stockholders; We are also subject to provisions of the Delaware corporation law that, in general, prohibit any business combination with a beneficial owner of 15 percent or more of our common stock for three years unless the holder’s acquisition of our stock was approved in advance by our board of directors. Although we believe these provisions collectively provide for an opportunity to receive higher bids by requiring potential acquirors to negotiate with our board of directors, they would apply even if the offer may be considered beneficial by some stockholders.

Our parent company owns 90% of our outstanding shares of common stock and may exert control over us and may exercise influence over matters subject to the approval of our shareholders.

Our parent company, Work Hard, owns 90% of the voting securities of the Company. Accordingly, it may exercise complete control over matters requiring shareholder holder approval, including the election of directors on the Board of Directors, expenditures, use of proceeds and approval of corporate transactions, such as a merger or sale of the Company.

Investor funds will not accrue interest while in escrow prior to closing.

All funds delivered in connection with subscriptions for the Shares will be held in a non-interest bearing escrow account until the closing of this Offering, if any. We may conduct one of more closings at our discretion. Investors in the Shares offered hereby may not have the use of such funds or receive interest thereon, pending the completion of this Offering.

Because we do not anticipate declaring any dividends on the common stock, capital appreciation, if any, will be your sole source of potential gain.

We currently intend to retain all of our future earnings, if any, to finance the growth and development of our business. As a result, capital appreciation, if any, of the Shares may be your sole source of gain for the foreseeable future.

Shareholders Will Have No Right to Control Company Operations.

The Investors in in this Offering will have no opportunity to control the day-to-day operations of the Company, including investment and disposition decisions. The investors must rely entirely on the Board and management to conduct and manage the affairs of the Company.

Our certificate of incorporation has an exclusive forum for adjudication of disputes provision which limits the forum to the Delaware Court of Chancery for certain actions against the Company.

Our certificate of incorporation, as amended, provides that the Delaware Court of Chancery, to the fullest extent permitted by law, is the sole and exclusive forum for certain actions including claims in the right of the Company brought by a stockholder that are based upon a violation of a duty by a current or former director or officer or stockholder in such capacity or as to which the Delaware corporate law confers jurisdiction upon the Court of Chancery of the State of Delaware. A Delaware corporation is allowed to mandate in its corporate governance documents a chosen forum for the resolution of state law-based shareholder class actions, derivative suits and other intra-corporate disputes. Our management believes limiting state law-based claims to Delaware mitigate against the potential risk of another forum misapplying Delaware law is avoided. In addition, Delaware courts have a well-developed body of case law and we believe limiting the forum for the adjudication of any disputes will prevent costly and duplicative litigation and avoid the risk of inconsistent outcomes. Our certificate of incorporation, as amended, provides that this exclusive forum provision does not apply to suits brought to enforce any liability or duty created by the Securities Act or the Exchange Act or other federal securities laws for which there is exclusive federal or concurrent federal and state jurisdiction. To the extent that any such claims may be based upon federal law claims, Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. Furthermore, Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. The Delaware Court of Chancery exclusive forum provision may limit a stockholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes with the Company or our directors, officers, employees or stockholders and may increase costs to stockholders residing outside of Delaware to bring claims, which may discourage such lawsuits against the Company and our directors, officers, employees or stockholders. Alternatively, if a court were to find this provision in our certificate of incorporation, as amended, to be inapplicable or unenforceable in an action, we may incur additional costs associated with resolving such action in other jurisdictions, which could adversely affect our business and financial condition.

HERE’S THE BOTTOM LINE

1

|

The online fitness market is booming – and experts project that this growth will continue for the next several years. Other companies that have brought unique, innovative products into this market in its early stages – such as Peloton, Mirror and others – are benefitting. |

2 |

GRIT EPIQ intends to enter the space with a bang, offering consumers an at-home experience unlike any other available today. |

3 |

GRIT EPIQ is a revolutionary, all-in-one, AI-powered at-home connected fitness technology that was designed by the same person behind the Peloton bike. |

4 |

GRIT EPIQ is now offering individual investors an opportunity to get in on the ground floor with an early-stage investment in the rapidly-growing online and connected fitness market. |

5 |

GRIT is led by an experienced, highly qualified management team and a team of fitness superstars – and it’s backed by a team of celebrities and renowned investors. |

6 |

Now you have an opportunity to invest alongside these other early-stage investors as the company builds equity and positions itself to establish a strong position in this rapidly-growing market. |

Investing in the company’s shares involves a high degree of risk. Please read the company’s Offering Circular, including the risks associated with an investment in the company discussed in the “Risk Factors” section, before making an investment decision.

Investing in the company’s shares involves a high degree of risk. Please read the company’s Offering Circular, including the risks associated with an investment in the company discussed in the “Risk Factors” section, before making an investment decision.

DOWNLOAD THE OFFERING CIRCULAR

THE INFORMATION PROVIDED HEREIN MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY.

These forward-looking statements are based on the beliefs of, assumptions made by, and information currently available to the company’s management. When used in the offering materials, the words “estimate,” “project,” “believe,” “anticipate,” “intend,” “expect” and similar expressions are intended to identify forward-looking statements. These statements reflect management’s current views with respect to future events and are subject to risks and uncertainties that could cause the company’s actual results to differ materially from those contained in the forward-looking statements. Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. The company does not undertake any obligation to revise or update these forward-looking statements to reflect events or circumstances after such date or to reflect the occurrence of unanticipated events.

Risks of early stage investment. Not an offer to buy or sell securities. This is a long-term speculative illiquid investment. Investment is not FDIC or SiPC insured. Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic’s investment criteria may invest.

This page and its branches (the “Site”) is maintained by OpenDeal Inc. and its subsidiary Republic Core LLC, neither of which are a registered broker-dealer (collectively, “Republic”). Republic does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of Republic, and a registered broker-dealer, and member of FINRA | SiPC , located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., Republic Core LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., Republic Core LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

OpenDeal Broker’s Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures.

By accessing the Site and any pages thereof, you agree to be bound by the OpenDeal Portal’s Terms of Use and Privacy Policy and/or OpenDeal Broker’s Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures.

Investors should verify any issuer information they consider important before making an investment.

Neither OpenDeal Inc., Republic Core LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 335 Madison Avenue, 16th Floor, New York, NY 10017, please check our background on FINRA’s Funding Portal page.